The Mayor of London has helped the city recover from Brexit and the pandemic in order to maintain its place as a top hub for financial talent.

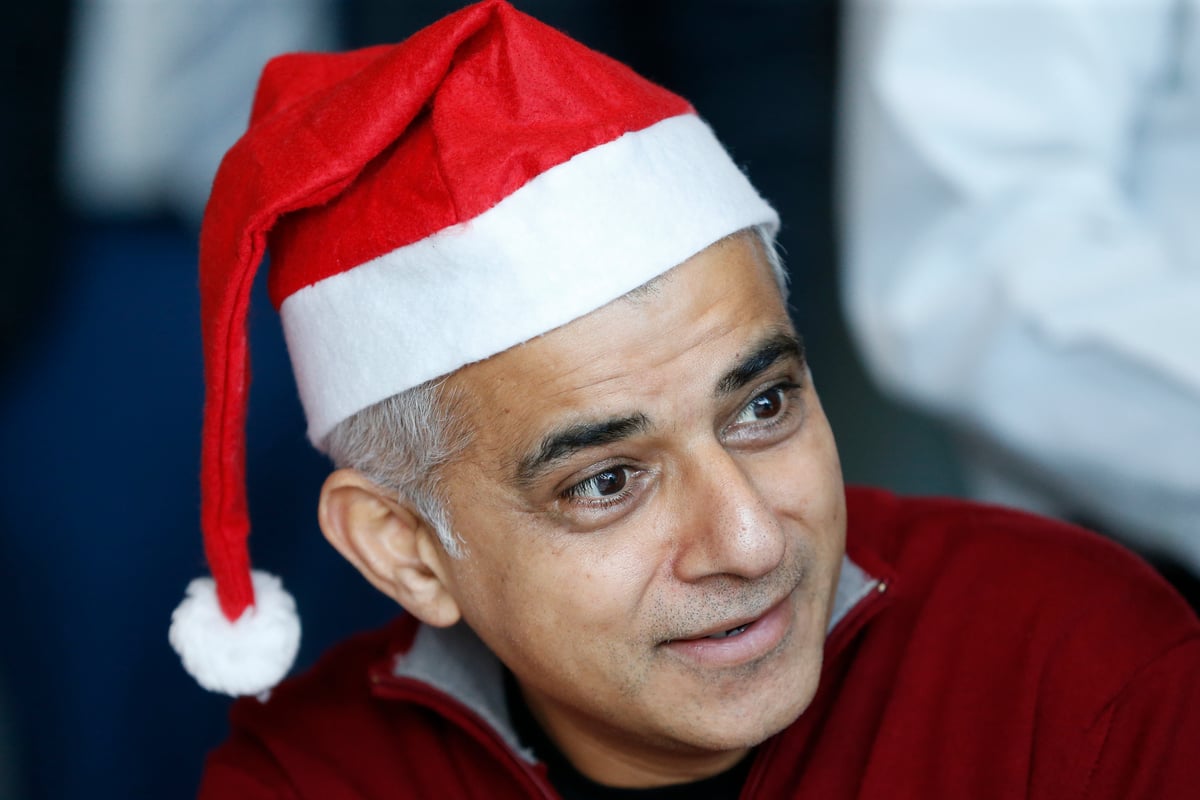

At the start of the New Year, Sadiq Khan cited fintech as one of the areas the city will continue to shine in, as well as benefiting from the boom in ESG investing across Europe.

“Despite the challenges, London will continue to be a leading global financial center,” said Khan Financial news. “Although Brexit has created some uncertainty and the pandemic has had a significant impact on our business operations, there are still high-quality talent choosing London. Our ecosystem provides access to growth capital, policymakers, infrastructure, world-class universities and talent in a single city, and our cultural appeal is stronger than ever. “

London’s position as the leading financial services destination came under unprecedented pressure in 2021. The city raised concerns about the lack of an “equivalence agreement” that would have allowed financial services companies in London to continue selling in the block.

As traders looked for workarounds, European regulators took an increasingly tough stance on those who tried to circumvent access rules using techniques such as “prudential supervision†and reverse solicitation.

At the turn of the year, Amsterdam overtook London’s top position in equity trading in Europe, surpassing the 8.6 billion euros traded daily in the city by quadrupling its own volume to 9.2 billion euros. While London would take that place in June, fears grew that New York would do more business as it led the way in new vehicles like Spacs.

READ Bankers watch New York win the crown of London’s financial center if the effects of Brexit take hold

However, commentators praised the government and regulators for a series of landmark reviews that have sought to make the UK more competitive in capital markets, including the Kalifa Review of UK Fintech and Lord Hills’s proposed overhaul of the city’s listing regime.

“London will continue to lead the way in fintech,” said Khan. “London’s position as a global financial center combined with its status as a global technology center has cemented the UK as a leader in fintech. It has the “flippers” of New York, the “technology” of the West Coast, and the policymakers of Washington, all within a 15-minute ride on public transit.

Since 2015, the number of fintech start-up and scale-up companies headquartered in London has increased by 64%, he said. “I expect that number will continue to grow.”

READEx-LSE boss Xavier Rolet says listing restructuring will attract top firms to London

The mood in the city was also heightened during the year when the European Commission called for an extension of the post-Brexit clearing deal for derivatives trading, a key market valued at around 90 trillion euros that London still dominates.

As the UK hosted the influential COP26 climate change conference in 2021 and ESG funds posted record inflows, with European products trending around 112.4 billion in the second quarter alone, well ahead of global competitors.

“London will take advantage of new opportunities in green finance. London is already the world’s leading center for green finance according to the Global Green Finance Index and the London Stock Exchange is the greenest in the world.

“COP26 was a milestone for green finance, and I will continue to build London’s profile on the global stage as the world’s best destination for green tech companies and business innovators to build on that momentum.”

To contact the author of this story with feedback or news, email Justin Cash

PLC 4ever

PLC 4ever